Citibank Bonuses to possess Examining 2025: As much as step 1,five-hundred

Blogs

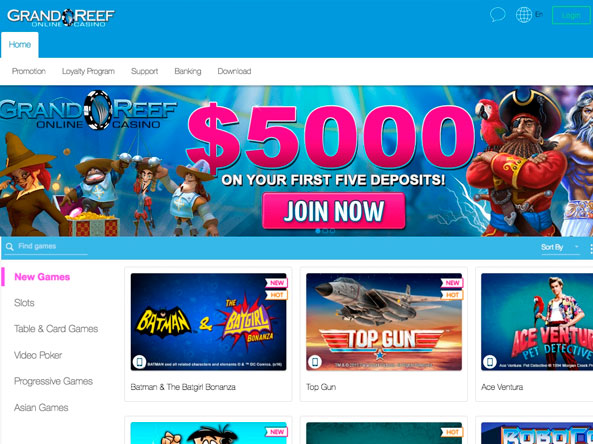

The corporation credit shines for the simplicity, generating endless dospercent cash return to your all the orders and wearing a sole-actually acceptance extra. Finally, if you are not willing to https://mrbetlogin.com/grandx/ create a top-prevent mastercard, evaluate these high starter notes otherwise one which have a great 0percent basic apr render. Because so many issuers have constraints about how precisely often you can generate a bonus to the a credit, it is important to go out your application to have whenever there is certainly an excellent render.

Any time you continue a cards once getting the bonus give?

Once you see a deal because of it card with over 90,000 items and you will a paying demands which you as well as your brief business can simply satisfy, it’s well worth implementing. A knowledgeable social acceptance render we have seen about this credit is actually short-resided. Inside June 2022, the newest Amex Silver upped the invited give for brand new candidates in order to 100,100 extra points once they spent 4,100 for the requests in the first half a year of card subscription. The fresh Rare metal Cards of American Show is certainly one of the most used superior cards in the market, even after their steep 695 annual payment (see rates and you can fees). Everything related to Citi checking profile could have been obtained because of the NerdWallet and it has perhaps not become reviewed otherwise available with the fresh issuer or supplier of the service or product.

- Make sure the webpages is up to your own conditions before making an account.

- Thus, if you curently have 5 credit cards open which have Western Share, then you will have to romantic a cards one which just become approved to own a different cards.

- At this time, Synchrony’s 13-Few days Video game offers a great 4.15percent APY, plus the best part?

- Current acceptance offers, such as the of them on this page, can merely struck five hundred or more in one credit.

- You have made high added bonus classes, in addition to professionals such as additional local rental automobile insurance and return shelter.

I am curious in case your bankbonus.com article you to definitely says “don’t intimate take into account six months” is actually a blunder. Like most of your federal banking companies, its rates aren’t great, however their unit breadth makes it simple so you can easily lender the during the you to put. As with any provide, don’t neglect to browse the conditions and terms just before beginning the new account. It’s in which the bank usually clearly condition who is entitled to the deal and one nuances you need to take note of. To get into cost and you can charge of the Western Share Gold Cards, come across these pages. To view rates and fees of your Delta SkyMiles Silver Western Show Card, discover this page.

What are an informed mastercard acceptance incentive to you personally

Provide credit, spend which have things and you may travelling or presents portal redemptions have other thinking with regards to the details of the redemption. One of the most important aspects out of a pleasant bonus is exactly how much you ought to purchase to be eligible for they. You need to make sure you is achieve the spending threshold instead overspending or and make requests your usually would not has.

For many who reach one to limit, you’ll earn 1percent cash return on the rest of their sales one to season. Cardmembers spend the money for exact same 695 annual percentage to the Team Platinum while the user Platinum (find cost and you will charge). The current Citi bank account incentives need you to sanctuary’t had a great Citi savings account within the last 365 weeks.

Information about the newest Marriott Bonvoy Endless Bank card could have been gathered separately from the Discover and has not been examined otherwise available with the new issuer of your cards past in order to publication. The new Citi Strata Largest Card features aggressive benefits costs and you can unlocks usage of all of the new Citi ThankYou transfer lovers, and this advances the property value the items. The brand new Ink Team Common Charge card is fantastic for small enterprises who want to secure plenty of versatile take a trip rewards. The newest Ink Business Preferred Credit card is an excellent team cards that have useful advantages, beneficial rewards and you will a big acceptance incentive. The Financing You to definitely Enjoy Cash Benefits Mastercard features among the best greeting bonuses, taking a premier return to possess a decreased paying specifications.

Because the financial bonuses are considered desire, once you file your taxation your’ll need to report people bonuses you’ve attained. You’ll need consider perhaps the tax accountability is worth the brand new added bonus count. The greater the average monthly equilibrium across the your own connected accounts (and checking, certification from deposit, IRA, offers and several money account) the greater amount of benefits and you can professionals you’ll get at Citi. Bankrate.com are an independent, advertising-offered blogger and you can assessment service.

The mixture render pays 900 and you can comes with so it 2 hundred checking render, a good 3 hundred discounts offer, and you will a 400 extra to possess carrying out each other. I would personally see you to combination just before undertaking possibly the newest checking or deals personally. I’m currently undertaking the benefit using them to have 900 for we.

Pursue enables you to rating an advantage all couple of years away from the last date you open a free account. If there is a primary put demands, I do not know of every ACH transfer that was effective at the relying because the a primary put. You will need to plan on making use of your employer or Societal Protection for the DD requirements. Do a month-to-month DD or keep the stability during the 1500 to own checking, 300 to have deals to avoid month-to-month costs. Pursue is actually legitimate to pay out bonuses punctually if you meet the requirements.

She actually is a publisher and you will author, excited about promoting informing posts to possess clients. Her content articles are in the recent banking reports, particularly incentives and you may new services. Brooke features created backup for various websites, along with blogs and reports releases. Brooke are a scholar from Clemson School that have a degree inside the Communications and a double small within the Brand Interaction and you may Composing inside the Media Training. It was provided for me personally via email and it generally seems to had been acquired by many people anyone else as to what I’ve already been reading in the brand new Reddit forums. Unlike past Amex lender bonuses (by far the most has just ended you to definitely ended to the Oct 8, 2022), this is a targeted render and never group gotten they nor is people qualified.

Possible cons, considering CNBC, are month-to-month repair costs and other fees. Or, you’re expected to make use of debit card or shell out costs from the the brand new account – based on and this financial you select. The brand new free incentive money is offered from the wants of Wells Fargo and you can Pursue in order to prize people after switching. The newest reviews are the specialist opinion of our writers, and not determined by any remuneration this site can get receive from card providers. This article isn’t available with any company said within this blog post. One feedback, analyses, reviews otherwise guidance conveyed listed below are those of the writer’s by yourself, and now have not started analyzed, approved or otherwise supported because of the these organization.

For those who’re looking to open a bank checking account which have an enormous federal lender that provides on the web speak service and you will well-rated mobile applications, Financial of The united states family savings incentives can be worth considering. If you can’t be eligible for the fresh Chase Sapphire Popular or are perhaps not looking its the brand new offer, the administrative centre One Campaign Perks Charge card is a great choice. It has an identical annual percentage and you may using demands (4,000 for the cards in the first 3 months) and you may produces a single-date incentive out of 75,100000 kilometers.

Take a look during the Fans Sportsbook software to see the new odds on pre-race preferences Denny Hamlin, Kyle Larson and you will Ryan Blaney. Completely, the brand new cards now will bring more than 2,700 inside yearly well worth. Here’s how to optimize your advantages for the Chase Sapphire Put aside. Lay a step 1 bet to the Caesars Sportsbook promo password so you can score (10) 100percent profit accelerates. Chances on the Tigers, Reds, Mets and Braves to any or all winnings to the Monday are in fact at the +950.